The Basic Principles Of Car Insurance

Wiki Article

The 20-Second Trick For Life Insurance

Table of ContentsSome Known Questions About Cheap Car Insurance.7 Easy Facts About Car Insurance ExplainedThe 7-Minute Rule for Car Insurance QuotesSome Known Details About Cheap Car Insurance

You Might Want Special Needs Insurance Too "In contrast to what lots of people assume, their residence or automobile is not their biggest property. Rather, it is their ability to make an earnings. Numerous professionals do not guarantee the chance of a special needs," said John Barnes, CFP as well as proprietor of My Household Life Insurance, in an e-mail to The Balance.

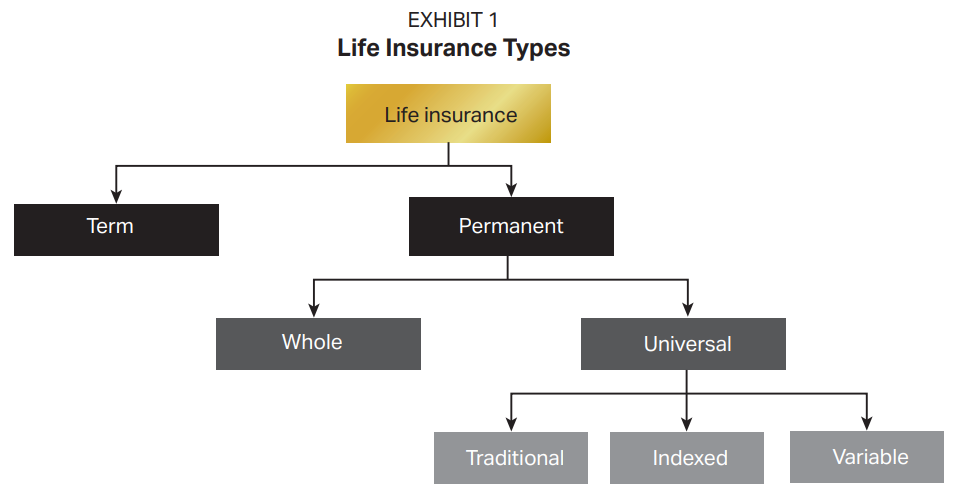

The details listed below concentrates on life insurance policy sold to individuals. Term Term Insurance is the easiest form of life insurance. It pays just if death takes place during the regard to the policy, which is typically from one to three decades. The majority of term policies have nothing else benefit provisions. There are two basic kinds of term life insurance policy plans: degree term and decreasing term.

The cost per $1,000 of advantage increases as the insured individual ages, and also it certainly obtains extremely high when the guaranteed lives to 80 and beyond. The insurance provider can charge a costs that raises every year, yet that would make it very hard for the majority of people to manage life insurance policy at advanced ages.

The Ultimate Guide To Insurance

Insurance coverage are made on the concept that although we can not quit regrettable events taking place, we can protect ourselves economically versus them. There are a substantial variety of various insurance plan available on the market, and also all insurance companies try to convince us of the values of their specific product. A lot to make sure that it can be challenging to determine which insurance plan are really necessary, as well as which ones we can realistically live without.Scientists have actually found that if the key wage earner were to die their family would just have the ability to cover their family costs for just a couple of months; one in 4 families would have troubles covering their outgoings immediately. Most insurers recommend that you get cover for around 10 times your yearly income - travel insurance.

You must additionally factor in child care costs, about his as well as future college costs if applicable. There are 2 main kinds of life insurance policy policy to pick from: entire life plans, as well as term life policies. You spend for whole life policies until you die, and you spend for term life policies for a set time period identified when you take out the plan.

Wellness Insurance policy, Health insurance policy is an additional among the 4 major types of insurance that experts suggest. A recent research exposed that sixty 2 percent of individual bankruptcies in the US in 2007 were as a straight result of illness. An unexpected seventy 8 percent of these filers had health and wellness insurance coverage when their ailment started.

3 Simple Techniques For Cheap Car Insurance

Premiums differ significantly according to your age, your existing state of health, and also your lifestyle. Also if it is not a legal requirement to take out automobile insurance coverage where you live it is extremely suggested that you have some type of policy in area as you will still have to assume economic responsibility in the case of a mishap.On top of that, your car is commonly one of your most valuable possessions, as well as if it is harmed in a crash you may struggle to spend for repair work, or for a replacement. You can likewise locate on your own accountable for injuries endured Look At This by your travelers, or the vehicle driver of an additional automobile, and also for damages created to another automobile as a result of your carelessness.

General insurance coverage covers residence, your travel, vehicle, and health (non-life assets) from fire, floodings, mishaps, synthetic disasters, and also burglary. Different kinds of basic insurance include electric motor insurance coverage, medical insurance, travel insurance policy, as well as residence read this insurance policy. A basic insurance coverage plan pays for the losses that are sustained by the guaranteed during the period of the policy.

Continue reading to recognize more concerning them: As the home is a valuable possession, it is essential to safeguard your home with an appropriate. House and home insurance safeguard your residence and also the items in it. A residence insurance plan basically covers man-made as well as all-natural situations that may lead to damage or loss.

Facts About Renters Insurance Revealed

When your vehicle is liable for a mishap, third-party insurance policy takes treatment of the damage caused to a third-party. It is additionally important to note that third-party motor insurance coverage is required as per the Motor Autos Act, 1988.

When it comes to health insurance, one can opt for a standalone health policy or a family floater strategy that offers protection for all family participants. Life insurance provides protection for your life.

Life insurance is different from general insurance policy on different criteria: is a short-term agreement whereas life insurance coverage is a long-term contract. In the situation of life insurance policy, the advantages as well as the sum assured is paid on the maturation of the plan or in case of the policy owner's fatality.

The basic insurance policy cover that is necessary is third-party responsibility cars and truck insurance coverage. Each and also every type of general insurance cover comes with an objective, to use protection for a specific element.

Report this wiki page